Advanced Financial Planning

Clients come to us for guidance on a range of advanced planning strategies. Our experienced wealth management professionals work closely with clients to handle a broad spectrum of their needs.

We provide advice on wealth enhancement, helping clients with matters involving cash flow planning, tax mitigation, and liability management. Our team also works with clients to protect their wealth, helping with everything from risk mitigation, to legal structures, to insurance advice. Additionally, we help clients with charitable giving and gifting strategies as well as wealth transfer and legacy planning.

Advanced Financial Planning

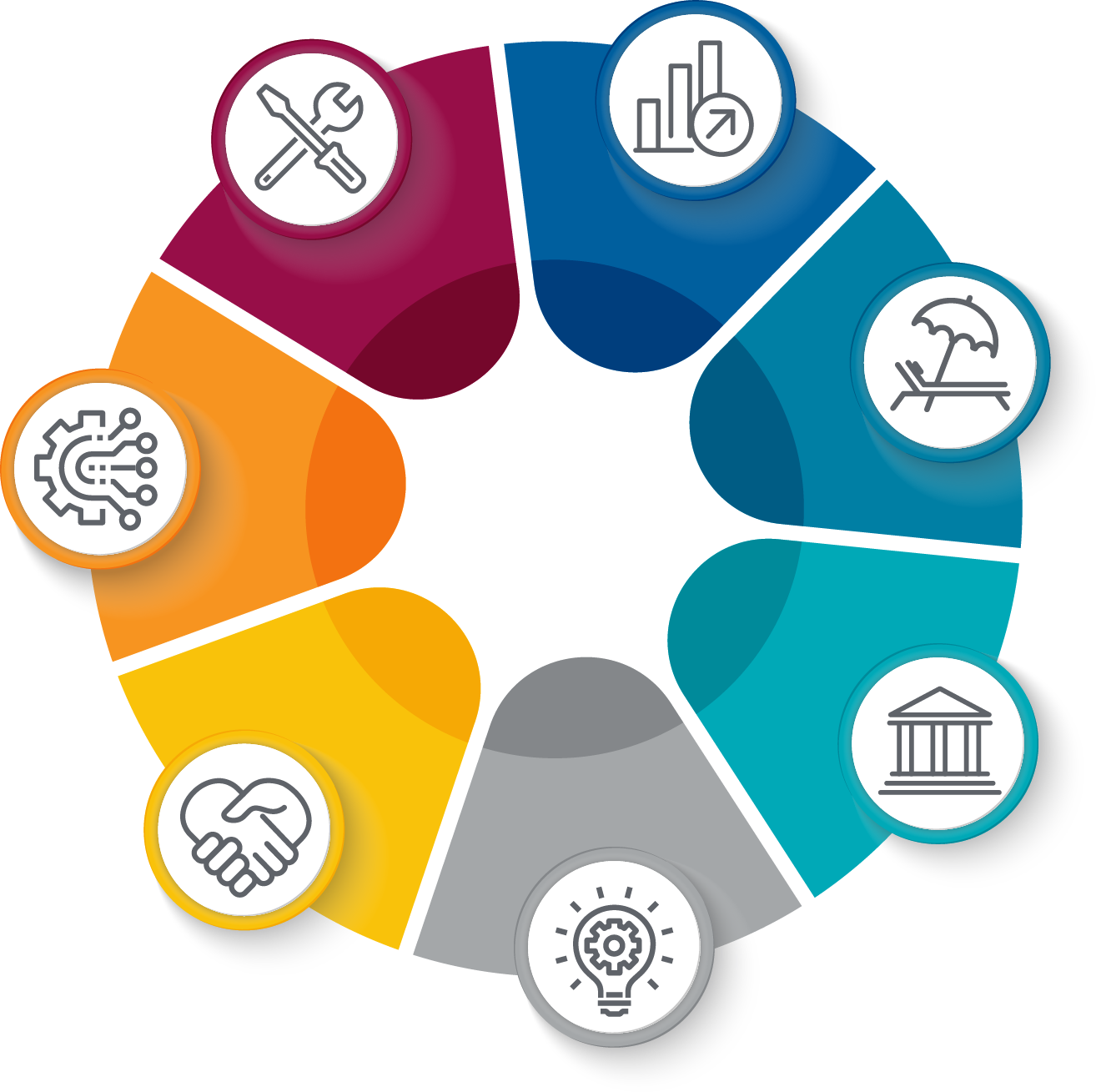

Delivering advanced planning: wealth management core areas

Insurance and Liability Management

- Goal protection

- Life insurance

- Long term care income protection

- Disability insurance

- Business overhead insurance

Family Needs Planning

- Comprehensive financial planning

- Education planning

- Special needs child assessment and planning

- Planning for support of aging parents

Business Succession Planning

- Goal protection

- Life insurance

- Long term care income protection

- Disability insurance

- Business overhead insurance

Estate Planning

- Wills

- Durable power of attorney (POA) for healthcare / POA-living will

- Trusts

- Gifting

Executive Compensation

- Concentrated stock services (monetizing, hedging)

- Stock option strategies

- Restricted securities (Liquidation and risk management alternatives)

- Estate and financial planning (Particular to executive compensation management)

Executive Compensation

- Retirement Planning

- Lifestyle review

- Risk review

- Pension and/or Social Security benefit analysis

- Retirement account assessment

- Retirement income plan

- Beneficiary review

Credit and Lending

- Home Loans

- Securities-based lending

- Personal credit management

- Charitable giving

- Asset titling

- Estate tax funding

- Family dynamic/family meeting