Business Value Acceleration and Transition Services

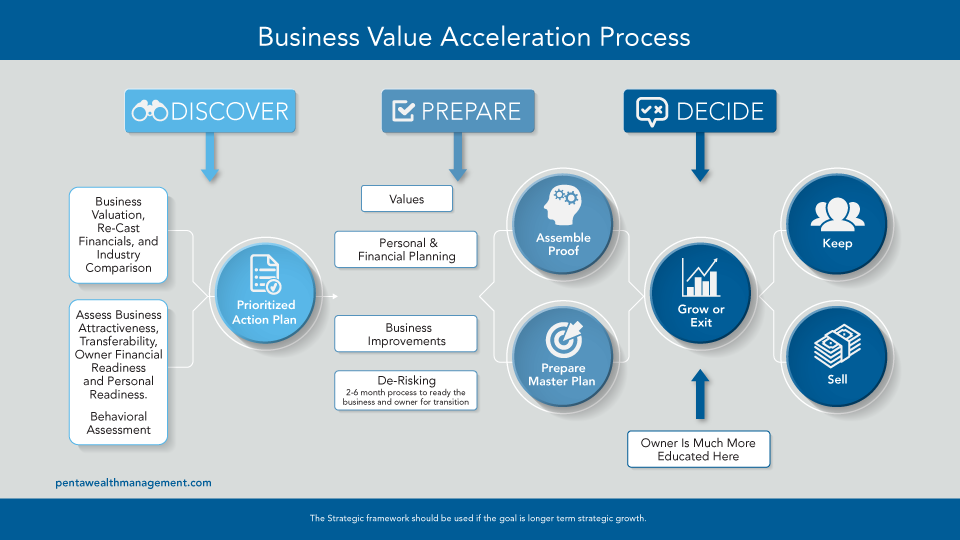

When the time and opportunity present itself, Penta Wealth Management can position you and your business to be ready for your exit. Proper exit planning should be an ongoing process that begins years before your exit. Our Value Acceleration and Transition Services break the entire process into three parts: Discovery, Preparation, and Decision. Each part of the process has multiple steps that must be completed in order to successfully pass through them.

From personal finance to value growth, taxes or legal issues, Penta Wealth Management will be with you through the duration of the process so that your transition is as smooth as possible. We know that gathering, assessing, modifying and monitoring numbers can be an in-depth and complicated process, which is even further complicated by increased competition, law changes and advances in technology. Penta Wealth Management will be there for you each step of the way.

Whether you’re a small, single-owner business with modest annual sales, or an owner of multiple large companies, we have the knowledge and experience to prepare you for a seamless exit. Members of the Penta Wealth Management team have been trained as Certified Exit Planning Advisors and Certified Value Growth Advisors™, which allows us to bring strategies to the table to help you meet your business objectives.

Step 1: DISCOVERY

Discovery is where we get to know you and your business, inside and out. In this stage, we will evaluate personal finances, your business’ benchmark value, tax records, estate plans, and more. These components allow our team to understand where you are and how to proceed through the exit planning process.

Assess Current Business Value and Personal Assets

Determining the value of your business, including personal assets and investments is the first step of the exit planning process. It is vital to have a baseline measurement to create your business, tax, estate, and personal financial plans. This information is used to create an action plan, which becomes the path that is used to drive you and your business toward its maximum value when it comes time to sell.

This part of the process might bring up things about your business you were not aware of. The valuation assessment allows us to determine where you are most at risk, and pinpoint potential earnings that are being left on the table.

This meeting begins the growth process and provides you with a picture of the value of your business, while allowing you to see where you can remove risk and increase value. This process includes an interview series and a self-assessment to determine the attractiveness of your business. This allows you to see what your business looks like from an outsider’s perspective. It is important to note that attractiveness does not translate to readiness to exit. While your business may be attractive from the outside, it has the potential to become unattractive to potential buyers after they have conducted their due diligence and examined its readiness for your exit. This is why assessing your current business value is critical.

Step 2: PREPARATION

The next step involves delivering and executing your action plan with your team. At this stage of the process, you should have held multiple workshops with your team, having come to a consensus on the vision of your business and how to prioritize each action step in your plan.

The best course of action is keeping your plan to 90-day sprints. This allows you to focus on what’s in front of you to more easily manage the changes that are necessary for a successful exit from your business. After completing the tasks in your 90-day plan, reset your focus and make preparations to begin the next 90-day sprint.

Turn Plans Into Action

Once you have completed the triggering action and come up with a series of 90-day plans, it is time to put those plans into action. Keeping the plans short and confined to one quarter of business help keep everyone focused and involved in the process.

We encourage you to complete five business objectives and five personal objectives during each of the individual 90-day plans. By successfully complete business and personal objectives, you are more driven to finish the quarter with tangible progress, giving you motivation for the next quarter. Each plan works towards completing your annual theme, getting you closer to the overall 3-5 year vision for your exit from your business.

At the end of each objective, you will be one step closer to completing your quarterly directives and increasing value multipliers that will increase your value. Your advisor will be there to assist you in recalibrating and reassessing your goals, as well as evaluating your progress and making decisions about selling or transferring your company.

Through the duration of the second step, Penta Wealth Management will assist in coordinating a series of workshops with your team. During these workshops, you will meet with your project leaders in a one-on-one workshop, occurring 3 times during each 90-day sprint. These meetings are a way to present progress updates, give individual feedback and provide encouragement for team members to complete assigned tasks in a timely fashion.

In addition to workshops, team accountability meetings will be held at the end of each month. Project leaders will present to the team about the status of projects to help with accountability and to make sure everyone is on track to make sure projects get completed.

Additionally, we will help conduct quarterly renewal workshops with the team. This is a great way to bring your team together to review successes and missed opportunities from the previous sprint, establish priorities and assign tasks to specific groups and team members.

Upon completion of a minimum of two 90-day cycles, your advisor will reevaluate your personal, financial and business value factors to reflect any changes that may have taken place. Continuous evaluation allows us to ensure you are staying on track to meet your goals.

Step 3: DECISION

When you enter into step 3, you and your advisor will have made a number of operational, personal and financial changes to your business, which should have become routine in the day-to-day activities within your company. Long-term goals will now become reality that requires you to contemplate the status of your company. This is a time to reflect on the past and come a conclusion about the future for you and your business.

To Keep or Sell? An Honest Evaluation Of Your Business

Penta Wealth Management is here to challenge you to be brutally honest with yourself when deciding if it is time to exit your business. Our readiness survey will ensure you are properly prepared to make this important decision. If you are not honest with yourself while answering these questions, there is the potential for severe consequences if you exit your business before you are truly ready.

The Penta Wealth Management team will reassess your tax and estate planning strategies to ensure they have had ample time to maximize your net proceeds. This allows us to present you with the best advice based on where you currently stand. The overarching goal is to position you and your business to make the transition the most beneficial for all parties.

Once a decision has been made, Penta Wealth Management will guide you through the exit options. Your advisor will help you list pros and cons of each option, and begin working on the steps for the option you choose. If you choose to not exit, but rather keep and grow your business, we will continue to work towards improving your growth and increase your business’ value.