Client accounts at Penta Wealth Management are held with The Charles Schwab Corporation (“Schwab”), one of the nation’s premier providers of financial services. With Schwab’s global strength, capabilities, and resources, combined with the personalized solutions of a family office private wealth management practice, our clients benefit from the best of both worlds.

Together, the PWM expertise and Schwab’s custodial services form a powerful alliance dedicated to helping our clients navigate the complexities of wealth management and achieve their long-term objectives.

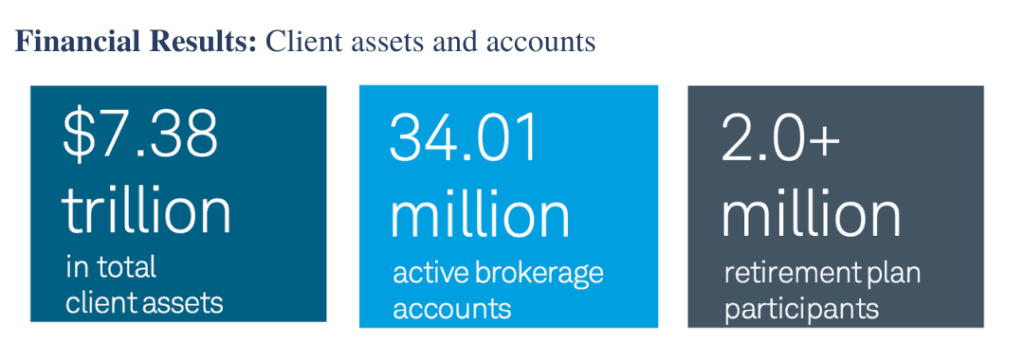

With $7.38 trillion in total client assets, The Charles Schwab Corporation offers an open architecture platform of competitively priced ETFs, mutual funds, and separately managed account strategies designed to best serve an investor’s central needs.

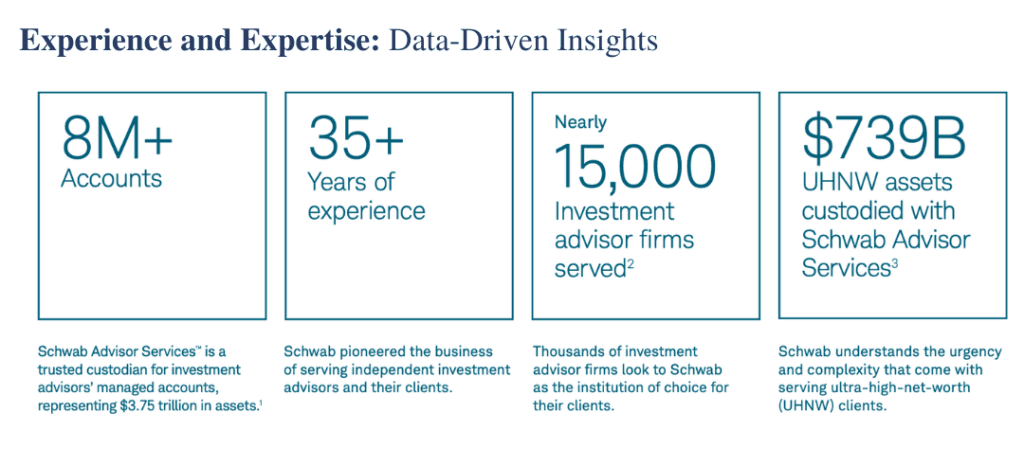

For more than 35 years, Charles Schwab has helped investment advisors deliver an exceptional experience to their clients. By leveraging Schwab’s expertise and cutting-edge technology, we can provide our clients with unparalleled visibility into their investments. From detailed reports to online and mobile account access, our clients have the tools they need to review their portfolio’s progress quickly and easily.

Disclosure: Schwab Advisor Services™ serves independent investment advisors and includes the custody, trading, and support services of Charles Schwab & Co., Inc. (“Schwab”). Independent investment advisors are not owned by, affiliated with, or supervised by Schwab.

Penta Wealth Management is proud to announce that we have been named as one of the Top Wealth Management Services Providers of 2023 by Banking CIO Outlook. The list recognizes the top firms who are at the forefront of delivering wealth management services and was determined using market research focused on peer/client recommendations and best practices. We are honored by this acknowledgment and proud of our team’s commitment to excellence.