By Jonathan Penta, Senior Wealth Advisor, Founder & Managing Director CEPA®

In the dynamic world of business finance, a private equity recapitalization (PE Recap) has become a popular way for companies to restructure and access new growth opportunities. This deal structure combines a purchase price with rollover equity, where private equity firms acquire part of the company, often injecting debt into the business to support expansion and shareholder liquidity.

A PE recap offers business owners a unique blend of benefits, including liquidity, continued ownership, potential access to strategic expertise, and a new way to align their financial strategies with investment opportunities. This article explores how PE recaps work, different types of recapitalizations, and the distinctions between PE recaps, asset purchases, and stock purchases.

What is Private Equity Recapitalization?

A private equity recapitalization is a financial transaction in which a private equity (PE) firm invests in a company by purchasing a portion of its equity. This recapitalization often involves leveraging debt as a tax shield, allowing the PE firm to buy into the business while retaining company owners’ equity and enhancing shareholder value. This form of recapitalization provides immediate cash to the selling shareholders while enabling them to maintain a share in future growth.

Key Scenarios for Private Equity Recapitalizations

Two common scenarios drive PE recaps:

- Partial Exit for Existing Owners: In this scenario, the original owners sell part of their ownership to the PE firm, allowing them to access liquidity without entirely exiting. The PE firm typically gains a controlling interest. At the same time, the owners retain a stake and stay involved in operations, allowing them to benefit from future growth and a potential “second bite at the apple” when the PE firm exits.

- Growth Capital Injection: Sometimes, a PE recap serves as a growth capital infusion. Here, the PE firm invests in the company to help it expand, often by financing new initiatives or acquisitions. The recapitalization introduces debt to fund this growth, giving the PE firm a substantial stake and active role in the company’s strategic decisions.

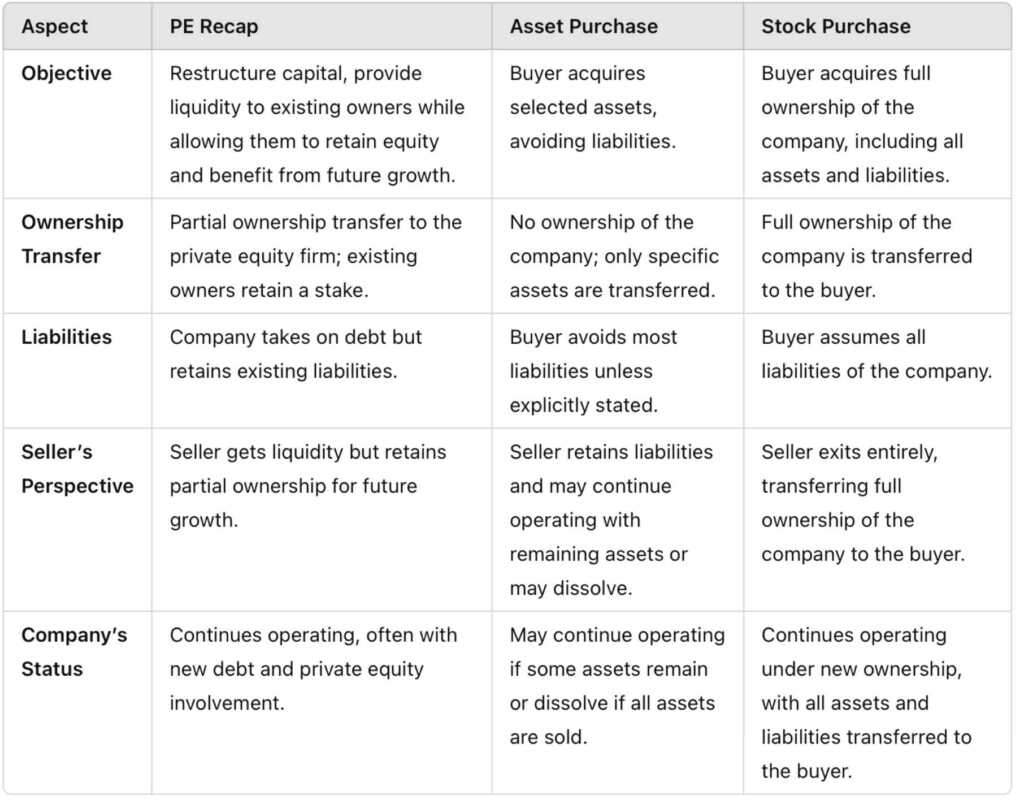

How PE Recaps Differ from Asset Purchases and Stock Purchases

A PE recapitalization differs fundamentally from other acquisition types, such as asset and stock purchases. Each has distinct implications for buyers and sellers. Understanding these differences, such as how each structure affects the company’s valuation, can help sellers decide which structure best suits their needs.

PE Recapitalization (PE Recap)

- Objective: A PE recap restructures a company’s financial base through debt and equity. The goal is to provide liquidity to existing owners while retaining their equity stake for future growth.

- Ownership Transfer: Only a portion of the ownership transfers to the PE firm, allowing existing owners to remain involved in operations.

- Liabilities: The company retains its liabilities, as the PE recap does not relieve it of debts or legal obligations.

- Seller’s Perspective: The selling owners gain liquidity without fully exiting the business. They retain a stake, allowing them to participate in future growth and the potential for a second payout when the PE firm exits.

Asset Purchase

- Objective: In an asset purchase, the buyer acquires specific assets, such as equipment, real estate, intellectual property, or inventory. This allows buyers to acquire revenue-generating assets while often leaving behind liabilities.

- Ownership Transfer: Only specific assets are transferred, not the entire company. If most assets are sold, the selling company may continue operating or wind down.

- Liabilities: Buyers typically avoid most liabilities associated with the original company, mitigating risks related to past operations.

- Seller’s Perspective: The seller offloads certain assets but retains liabilities unless transferred explicitly in the purchase agreement. This transaction may be advantageous for companies looking to liquidate parts of the business rather than a complete sale.

Stock Purchase

- Objective: A stock purchase involves buying the company’s shares, thus acquiring the entire business, including assets, liabilities, contracts, and operations.

- Ownership Transfer: The buyer gains full company ownership, assuming all assets and liabilities.

- Liabilities: Buyers assume all known and unknown liabilities, taking on the company’s full financial history.

- Seller’s Perspective: The seller transfers complete ownership and exits the company, making this a full exit strategy that includes all assets and obligations.

Key Differences

Key Considerations in a PE Recap

A PE recap, which can include dividend recapitalization, requires careful planning, as the capital structure and terms of the transaction have long-term impacts on the sellers, the company, and its future growth. Here are essential elements to consider:

1. Majority vs. Minority Recaps

In a majority recap, the PE firm purchases a controlling interest, often exceeding 50% ownership. This gives the PE firm decision-making power, though existing owners may retain operational roles. In contrast, a minority recap involves the PE firm taking a minority position, allowing the existing owners to maintain control.

Most PE recaps are structured as majority recaps, enabling the private equity firm to guide the company’s growth and ensure alignment with its strategic objectives.

2. Treatment of Rollover Equity and Pari Passu

Sellers in a PE recap often retain some of their equity through rollover equity, meaning they roll a portion of their shares into the newly recapitalized entity. Sellers must negotiate terms for this rollover equity to be pari passu with the private equity firm’s equity.

In finance, pari passu means “equal footing,” ensuring that sellers’ rollover equity carries the same rights, preferences, and conditions as the buyer’s equity. This is crucial because, in a future sale, pari passu equity allows sellers to participate equally in profits rather than having junior or subordinated rights.

3. Choosing Between Cash or Stock

During a recapitalization, sellers may receive cash and stock in the new entity. While cash offers immediate liquidity, stock in the new company presents potential long-term gains. Sellers should weigh the benefits and risks of receiving stock, as illustrated by cases where stock appreciation significantly outpaced the initial cash value over time.

4. Evaluating Multiple Letters of Intent (LOIs)

When entertaining multiple offers, sellers should scrutinize prospective buyers’ LOIs (Letters of Intent). Key elements to examine include equity terms, treatment of rollover equity, control provisions, capital structure, and exit strategy. A favorable LOI may balance an attractive purchase price and advantageous equity terms.

Benefits and Challenges: A Deep Dive

A Private Equity recapitalization offers several compelling benefits for sellers and the company, primarily:

- Liquidity: Sellers gain immediate liquidity by selling a portion of ownership, allowing them to diversify their wealth while retaining a stake in the company.

- Continued Ownership: Sellers can maintain a stake, enabling them to benefit from future growth and potentially higher payouts at the PE firm’s exit.

- Growth Capital: PE firms bring capital, industry expertise, and strategic guidance, which can accelerate the company’s growth through equity financing.

- Enhanced Financial Returns: Leveraging debt through the recap can increase returns for equity holders, though it also introduces financial risk.

Risks and Challenges in a PE Recap

Despite its advantages, a PE recap presents risks that sellers should carefully evaluate:

- Increased Debt Load: Recapitalizations typically involve new debt, which can strain cash flow and financial stability if the company’s growth does not meet expectations, making debt restructuring a potential necessity.

- Control Shift: Majority recaps may shift decision-making power to the PE firm, potentially reducing the seller’s control over the business.

- Future Exit Strategy: PE firms generally plan to exit within 5-7 years, meaning the company will likely face another ownership transition, which can impact long-term planning.

Practical Example of Asset vs. Stock Deal Considerations in a PE Recap

To illustrate, consider a C-Corp company exploring stock and asset deal options during a recap. In an asset purchase, buyers pay for specific assets but avoid corporate debt and liabilities, leaving the company to handle any taxes associated with asset sales. In contrast, in a stock purchase, the buyer acquires the entire entity, liabilities included, which can mean dual taxation for C-Corps—firs on the asset sale and again when distributing funds to shareholders.

In such cases, PE buyers may offer a price that justifies an asset deal over a stock deal, considering tax implications and structuring flexibility.

Tips for Sellers: Navigating the PE Recap Process

- Understand Your Options: Research PE recaps, asset, and stock purchases. Consult with experts to determine which structure best aligns with your goals.

- Prioritize Pari Passu Equity: Ensure rollover equity terms are on equal footing with the buyer’s equity to maximize your payout during a future sale.

- Negotiate Control Terms: Clearly define your role in company management post-recap, especially in majority deals, to avoid unexpected shifts in control.

- Consider Tax Implications: Evaluate how the recap structure will impact your taxes and overall financial outcome, particularly for stock versus asset deals.

A private equity recapitalization (PE recap) provides companies a flexible way to achieve liquidity, leverage existing assets in their portfolio, retain ownership, and optimize capital structure to gain access to growth capital. However, the deal’s success hinges on understanding its implications—particularly regarding debt, equity terms, control, and future exit strategies. Sellers should work with financial and legal advisors to ensure the recap structure aligns with their financial goals and prepares the company for long-term success.

Penta Wealth Management offers tailored solutions to help individuals and businesses meet financial goals. Through their consultative approach, Penta provides expert guidance on investment, advanced planning, and transition services, helping clients navigate complex financial challenges with a focus on long-term success. Their holistic services emphasize strategic growth and risk management to support sustainable wealth-building and legacy planning.